The Takeaway is a periodic blog by Lumira Ventures that covers themes and trends within the fast-growing Canadian healthcare innovation ecosystem. Please note that the views and opinions expressed in this article are those of Lumira Ventures and do not reflect the official policy or position of any of our investors, co-investors, or external partners.

Authors: Nikhil Thatte, Principal and Peter van der Velden, Managing General Partner

2020: A Notable Year for Canadian Healthcare Innovation

While the year is still far from over, 2020 has already been and will without a doubt be the most eventful year in recent memory for Canada and the world-at-large. By year’s end, 2020 will also likely go down as the single most successful year to date for Canadian healthcare innovation. In January, Zymeworks (NASDAQ: ZYME) and Aurinia (NASDAQ: AUPH) both achieved market capitalizations of over CAD$2.5B, making them two of the most valuable Canadian biotechs to emerge in two decades. In Q2 2020, two high profile Canadian biotech companies Fusion Pharmaceuticals (NASDAQ: FUSN) and Repare Therapeutics (NASDAQ: RPTH) completed significant IPOs and Vancouver-based Abcellera is potentially on track to IPO by the end of the year. These companies’ successes represent the culmination of longstanding effort by various stakeholders in the Canadian healthcare ecosystem including healthcare entrepreneurs, academia, government, venture capitalists and many others. Today, Canada is recognized at the forefront of medical innovation, something that was difficult to conceive of 15 years ago. Today our prominent researchers, leading academic/research institutions, strong preclinical and clinical trial infrastructure, world-recognized healthcare system, increasing access to capital and ‘been-there-done-that’ homegrown healthcare entrepreneurs and talent has made Canada an ideal place to launch the next generation of life science companies. In this inaugural, two-part edition of The Takeaway, we take a look back at the evolution of Canadian healthcare innovation and forecast what lies ahead.

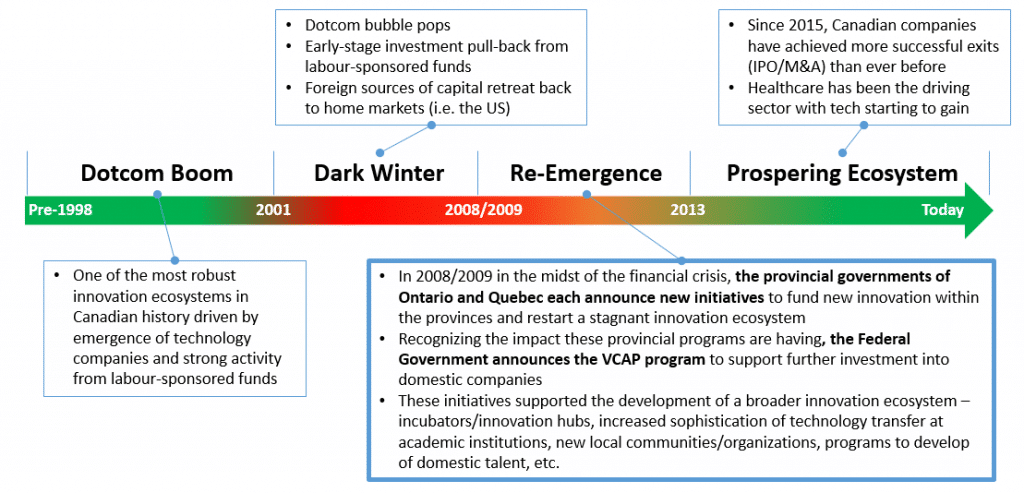

The Old Saying about Falling Off a Horse

In the late 1990s, Canada’s innovation ecosystem was thriving, driven by both the internet boom and heavy investment into new companies by Canadian labour-sponsored funds. Unfortunately the success was short lived with the pop of the dotcom bubble in the early 2000s. What followed was an 8 year ‘Dark Winter’ period in Canada as the labour sponsored phenomena was unwound, domestic capital for innovation investing eroded and US and other foreign investors retreated to their home bases. The VC market would crumble from a high of CAD$5.9B in 2000 to a low of CAD$1.1B in 2009 following the economic collapse in 2008. This thrust a fresh spotlight on the need for domestic innovation centric capital to reset a struggling economy. Giving credit where credit is due, it was the Ontario and Quebec Provincial governments that recognized this need and announced significant public financial commitments to restart investment back into early stage companies. This led to the formation of the Ontario Venture Capital Fund (OVCF) managed by Northleaf Capital in 2008 and the Teralys Capital Fund in Quebec in 2009. In 2012, the Federal government followed suit with the Venture Capital Action Plan (VCAP) program, allocating nearly CAD$390M toward four Fund-of-Funds and four high-performing VC funds (including Lumira Ventures). These Funds then brought in almost a billion dollars of incremental capital, pushing the total to CAD$1.4B of capital for the innovation sector. Despite the fact that more than 80% of this capital ended up in the tech sector, and while a significant portion of the capital allocated to healthcare went to foreign domiciled firms (a much higher percent than in the tech sector) there is no doubt that Provincial and Federal Government investment did serve as the meaningful catalyst to reinvigorate Canadian innovation across all industries including healthcare.

“Throwing dirt on a seed increases its value”

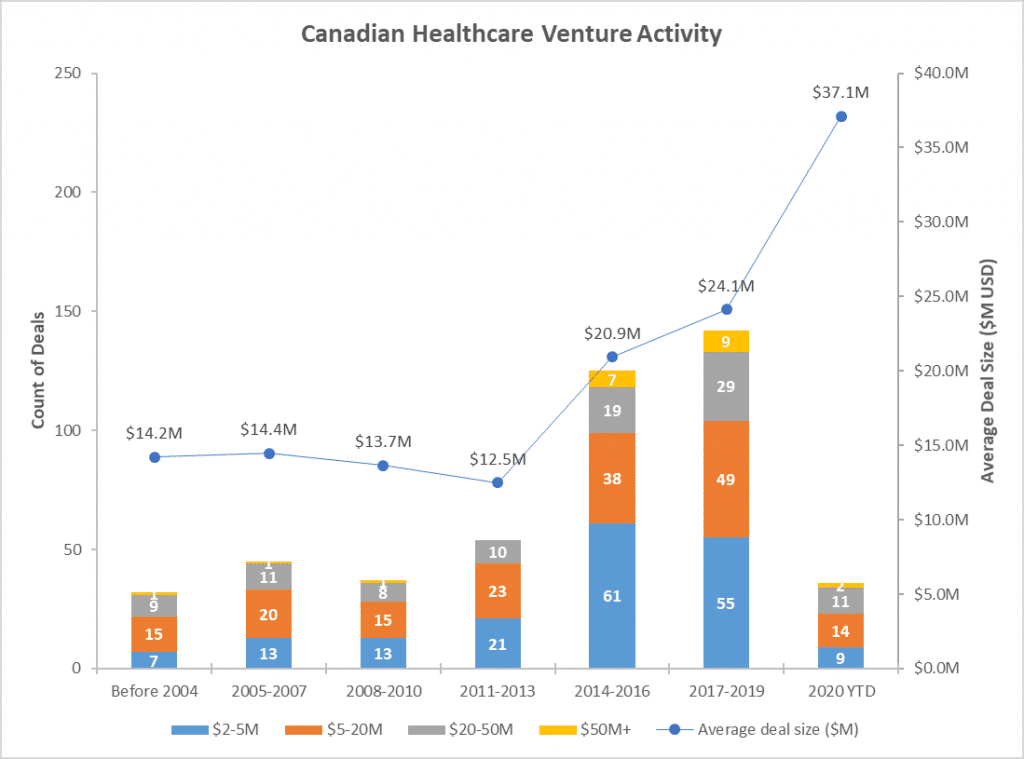

Source: Crunchbase extract of all completed venture deals >$2M USD by Canadian-based companies YTD to October 8th, 2020; includes therapeutics, medical devices, and digital health.

Evaluating historical Canadian healthcare venture deals in 3 year periods, it is clear that VCAP-funded VCs helped fuel significant venture investment into the healthcare sector. These initial commitments served to provide companies with deeper initial access to capital which in turn allowed them to attract the attention and investment of domestic investors and co-investors south of the border. Getting both domestic and foreign VC interest has historically be a necessary right of passage for most life science companies to scale and achieve their business objectives. Not only have the number of venture deals increased, but the average size of these deals has increased as well, highlighting the growing confidence the investment community has in Canadian healthcare innovation. But there have been issues. The reliance on a foreign ecosystem to scale our best Canadian healthcare innovation has meant that much of the ultimate value realization goes into the pockets of foreign investors. This unfortunately is not a sustainable model. We simply cannot be the “farm team” for foreign investors.

In Part 2 we’ll take a look at IPOs, follow-on financing, exits and preview what this means for Canada’s life science innovation ecosystem going forward.