VANCOUVER, British Columbia–(BUSINESS WIRE) May 2, 2019– Zymeworks Inc. (NYSE/TSX: ZYME), a clinical-stage biopharmaceutical company developing multifunctional therapeutics, today reported financial results for the first quarter ended March 31, 2019.

“We are pleased to have advanced both of our lead assets to the next stages of clinical development; recently commencing a Phase 2 study for ZW25 and starting enrollment in the Phase 1 clinical trial for our antibody-drug conjugate, ZW49,” said Ali Tehrani, Ph.D., Zymeworks’ President & CEO. “Accordingly, we have also exp

anded our leadership team, adding experienced executives with critical competencies needed to facilitate the development and approval of our clinical-stage assets. We believe we are now well-positioned to deliver on our ambitious clinical goals throughout 2019 and beyond.”

First Quarter 2019 Business Highlights and Recent Developments

- Phase 2 Clinical Trial Begins for ZW25 in First-Line HER2 Expressing Metastatic Gastroesophageal Cancers

The Phase 2 trial is evaluating ZW25 in combination with standard of care (SOC) chemotherapy for the first-line treatment of HER2-positive metastatic gastroesophageal cancers. This trial is intended to support a potential first-line registrational trial and could position ZW25 as a new SOC.

- Phase 1 ZW49 Clinical Study Open and Enrolling Patients

Enrollment is underway in the United States for the Phase 1 clinical trial of ZW49, Zymeworks’ novel bispecific HER2-targeted antibody-drug conjugate. The objectives of this study are to evaluate safety and early anti-tumor activity as well as establish a recommended dose for future clinical trials.

- Three Experienced Development Executives Added to Management Team

Zymeworks expanded its leadership team and added key functional expertise to support the development of its maturing clinical pipeline. The newly created positions include Neil Josephson, M.D., Vice President, Clinical Research; Bruce Hart, Ph.D., Vice President, Regulatory Affairs; and Mark Hollywood, Senior Vice President, Technical and Manufacturing Operations.

- Eli Lilly and Daiichi Sankyo Programs Advance Toward Clinical Testing

Zymeworks’ partner, Eli Lilly, filed an Investigational New Drug Application for its second Azymetric™ program, triggering a US$8.0 million payment to Zymeworks. In addition, Daiichi Sankyo recently exercised its option for a commercial license to an immuno-oncology bispecific built using Zymeworks’ Azymetric and EFECT™ platforms. Zymeworks will receive a US$3.5 million payment.

Financial Results for the Quarter Ended March 31, 2019

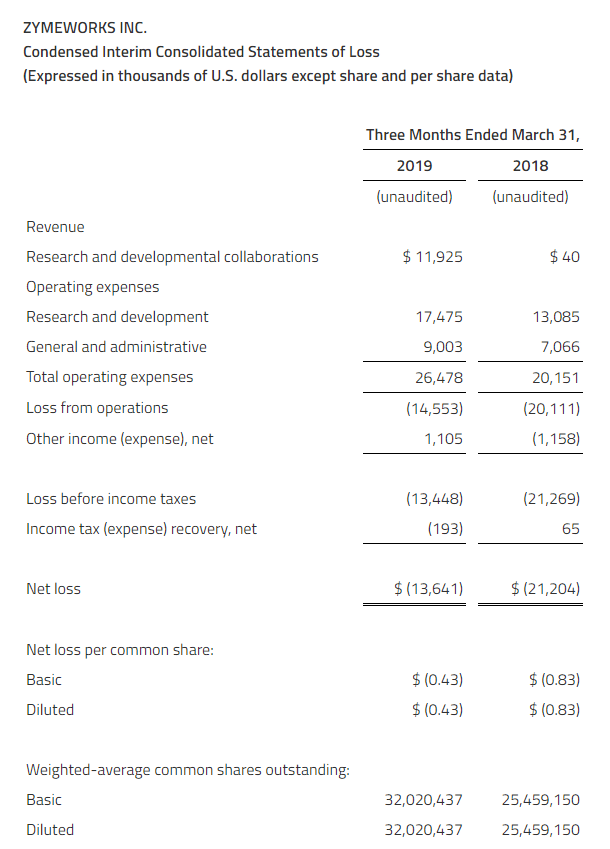

Revenue for the three months ended March 31, 2019 was $11.9 million as compared to $0.04 million in the same period of 2018. Revenue for 2019 includes an $8.0 million development milestone payment upon Lilly’s submission of an investigational new drug application, $3.5 million of recognized deferred revenue from our licensing and collaboration agreement with BeiGene, as well as $0.4 million in other research support payments. Revenue for the same period in 2018 was $0.04 million, consisting of research support payments.

For the three months ended March 31, 2019, research and development expenses were $17.5 million as compared to $13.1 million in the first three months of the prior year. The change was primarily due to an increase in clinical trial activity and associated drug manufacturing costs for ZW25, as well as an increase in other research and discovery activities as compared to the same period in 2018. Research and development expenses also included non-cash stock-based compensation expense of $1.1 million from equity classified equity awards and $0.4 million expense related to the non-cash mark-to-market revaluation of certain historical liability classified equity awards.

For the three months ended March 31, 2019, general and administrative expenses were $9.0 million as compared to $7.1 million in the first quarter of 2018. The change was primarily due to an increase in employee compensation expenses from increased head count in 2019 over 2018, including non-cash stock-based compensation, as well as other increases in professional fees associated with year-over-year corporate growth. General and administrative expenses included non-cash stock-based compensation expense of $1.5 million from equity classified equity awards and $1.3 million expense related to the non-cash mark-to-market revaluation of certain historical liability classified equity awards.

The net loss for the three months ended March 31, 2019, was $13.6 million as compared to $21.2 million in the same period of 2018. This was primarily due to increased revenue, interest income and 2018 warrant valuation expense, which was not relevant for 2019, that offset an increase in research and development expenses associated with our lead therapeutic candidates and other programs as well as general and administrative expenses.

Zymeworks expects research and development expenditures to increase over time in line with the advancement and expansion of the Company’s clinical development of its product candidates, as well as its ongoing preclinical research activities. Additionally, Zymeworks anticipates continuing to receive revenue from its existing and future strategic partnerships, including technology access fees and milestone-based payments. However, Zymeworks’ ability to receive these payments is dependent upon either Zymeworks or its collaborators successfully completing specified research and development activities.

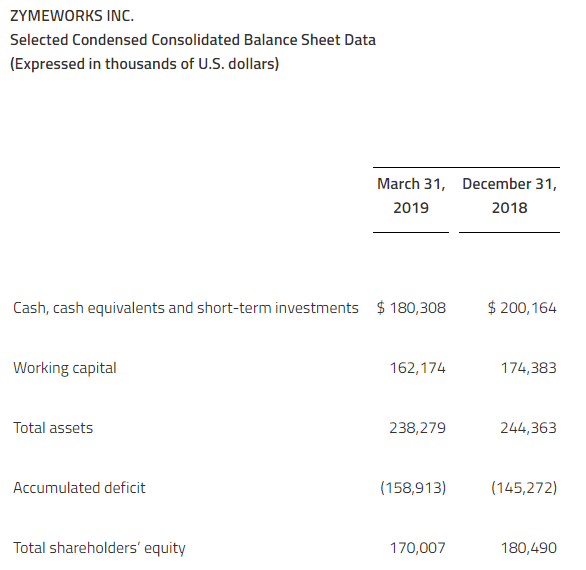

As of March 31, 2019, Zymeworks had $180.3 million in cash and cash equivalents and short-term investments.

About Zymeworks Inc.

Zymeworks is a clinical-stage biopharmaceutical company dedicated to the development of next-generation multifunctional biotherapeutics. The Company’s suite of therapeutic platforms and its fully integrated drug development engine enable precise engineering of highly differentiated product candidates. Zymeworks’ lead clinical candidate, ZW25, is a novel Azymetric™ bispecific antibody currently in Phase 2 clinical development. The Company’s second clinical candidate, ZW49, is a bispecific antibody-drug conjugate currently in Phase 1 clinical development and combines the unique design and antibody framework of ZW25 with Zymeworks’ proprietary ZymeLink™ cytotoxic payload. Zymeworks is also advancing a deep preclinical pipeline in immuno-oncology and other therapeutic areas. In addition, its therapeutic platforms are being leveraged through multiple strategic partnerships with eight global biopharmaceutical companies. For more information, visit www.zymeworks.com.

Cautionary Note Regarding Zymeworks’ Forward-Looking Statements

This press release includes “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995 and “forward-looking information” within the meaning of Canadian securities laws, or collectively, forward-looking statements. Forward-looking statements in this news release include, but are not limited to, statements that relate to potential payments and/or royalties payable to Zymeworks under its corporate agreements, the speed and outcome of drug development plans, ZW25’s ability to be approved and become a standard-of-care treatment for certain types of cancer, Zymeworks’ potential global growth, and other information that is not historical information. When used herein, words and phrases such as “enable”, “will”, “may”, “expect”, “anticipate”, “eligible to”, and similar expressions are intended to identify forward-looking statements. In addition, any statements or information that refer to expectations, beliefs, plans, projections, objectives, performance or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking. All forward-looking statements are based upon Zymeworks’ current expectations and various assumptions. Zymeworks believes there is a reasonable basis for its expectations and beliefs, but they are inherently uncertain. Zymeworks may not realize its expectations, and its beliefs may not prove correct. Actual results could differ materially from those described or implied by such forward-looking statements as a result of various factors, including, without limitation, market conditions and the factors described under “Risk Factors” in Zymeworks’ Quarterly Report on Form 10-Q for its quarter ended March 31, 2019 (a copy of which may be obtained at www.sec.gov and www.sedar.com). Consequently, forward-looking statements should be regarded solely as Zymeworks’ current plans, estimates and beliefs. Investors should not place undue reliance on forward-looking statements. Zymeworks cannot guarantee future results, events, levels of activity, performance or achievements. Zymeworks does not undertake and specifically declines any obligation to update, republish, or revise any forward-looking statements to reflect new information, future events or circumstances or to reflect the occurrences of unanticipated events, except as may be required by law.

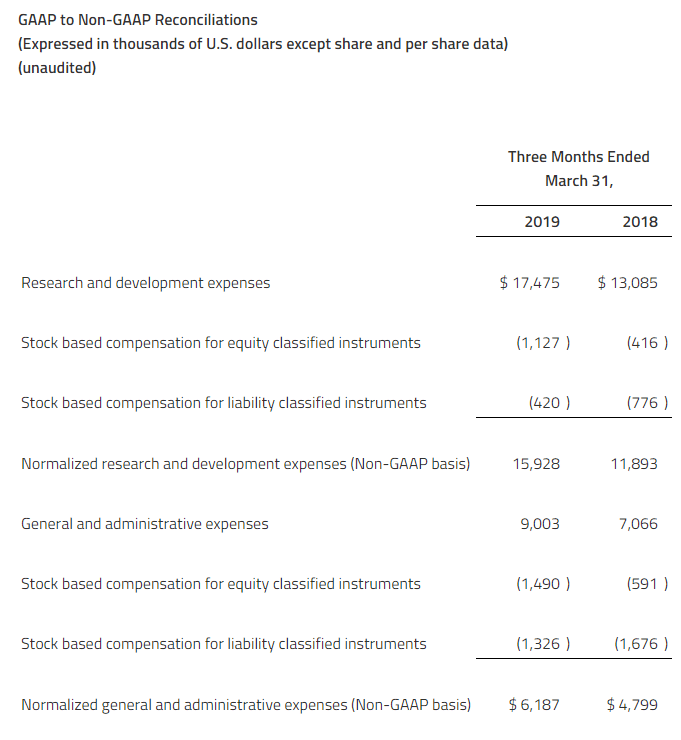

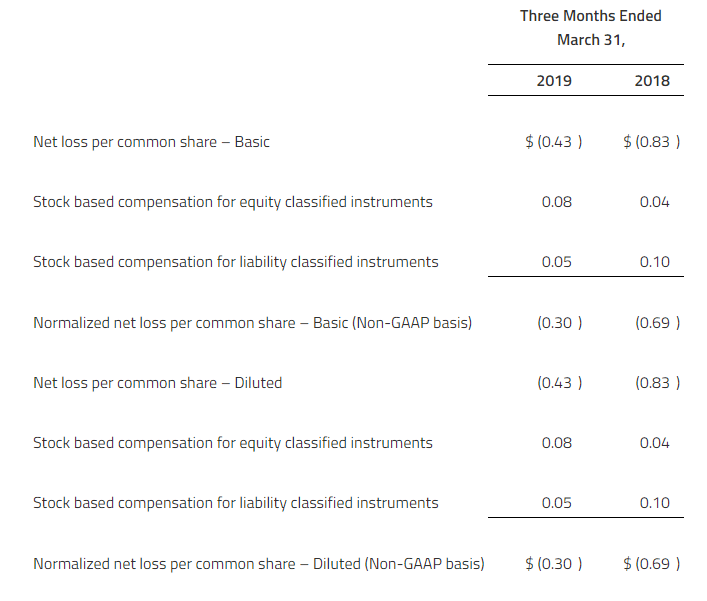

NON-GAAP FINANCIAL MEASURES

In addition to reporting financial information in accordance with U.S. generally accepted accounting principles (“GAAP”) in this press release, Zymeworks is also reporting normalized expenses and normalized loss per share, which are non-GAAP financial measures. Normalized expenses and normalized loss per share are not defined by GAAP and should not be considered as alternatives to net loss, net loss per share or any other indicator of Zymeworks’ performance required to be reported under GAAP. In addition, Zymeworks’ definitions of normalized expenses and normalized loss per share may not be comparable to similarly titled non-GAAP measures presented by other companies. Investors and others are encouraged to review Zymeworks’ financial information in its entirety and not rely on a single financial measure. As defined by Zymeworks, normalized expenses represent total research and development expenses and general and administrative expenses adjusted for non-cash stock-based compensation expenses for equity and liability classified equity instruments.

Normalized expenses are a non-GAAP measure that Zymeworks believes is useful because it excludes those items that Zymeworks believes are not representative of Zymeworks’ operating expenses.

Zymeworks Inc.

Investor Inquiries:

Ryan Dercho, Ph.D.

(604) 678-1388

ir@zymeworks.com

Tiffany Tolmie

(604) 678-1388

ir@zymeworks.com

Media Inquiries:

Angela Bitting

(925) 202-6211

a.bitting@comcast.net

Related Articles:

Zymeworks Adds Experienced Executives to Management Team to Support Clinical Development

Investigational New Drug (IND)-Submission Milestone Achieved in Lilly Collaboration